The forges of the economy

1. Introduction

2. The symmetrical debt

3. The progressive interest rate

4. Conclusion

This new was produced because if China tries to use its financial yoke on the United States by selling savings bonds or Treasury bills of the US government. Having studied in the financial field, and having done research for many years in this area and in areas “connected,” my inspiration was such that he did not take much effort to find the solution to the potential takeover of the Chinese Communist Party. In any case, according to the US government, there is no risk with the liquidation of China’s treasury bills.

After further reflection, I have refined this document to reflect the effect of increasing the amount of electronic money by offering an additional solution to further protect of the potential actions they could judge “dark” by the Chinese government. Since in any case, China was liquidating treasury bills to fix its exchange rate, not to hurt the US government.

This document proposes an invention that cannot be used alone without the other invention to increase the savings rates and reduce the cost of borrowing (note: this second invention is not yet digitized, pending an agreement with the parties concerned).

|

Back to the top of the page |

Given that if China wants to liquidate titles … the US government can redeem by creating a “symmetric debt.” This means that the government does not need to have cash to repurchase its securities. The debt level remains the same, and in addition, it is more advantageous in certain situations. A company cannot use this solution but a government can do.

The symmetrical debt works as such: the government temporarily creates electronic money in a bank buys back its securities sold on the market, and is indebted to himself that is the same debt. The debt has neither increased nor decreased, but on the portion of the repurchased securities, the government has no interest payable. At the eventual repayment of its securities, the government is phasing out the same amount of electronic money.

In the case of the US government and an abstraction to a potential economic conflict with China, the electronic money the government has issued on the market has no negative impact since in any case, China does nothing with American money … money remains in its coffers! The US government is a forge to revive its economy with the symmetric debt because many countries keep the money Americans in their coffer. And it’s better than going bankrupt!

Furthermore, with the solution proposed in the next section “The progressive interest rate,” we eliminate borrowing money, which results in reducing the amount of electronic money in the market. This is what comes to compact the amount of electronic money.

|

Back to the top of the page |

In the event that the solution proposed in the previous section would be in effect in the United States, I propose the following solution for where a measure against inflation if China would use the money: this is called rate progressive interest, which would be imposed on bank loans in the United States.

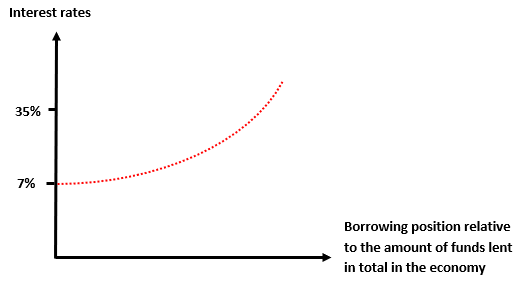

Here’s how the progressive interest rate. First, knowing that the money from China would possibly be transferred to the United States, the banks covered by the deposit of such amount of money would be having to assign a rate progressively higher on borrowing by their clients, thus restricting the amount of money in circulation … which would lessen the effect of having created so many electronic money into the economy by the symmetrical debt.

And so even the interest income on bank deposits, banks could pay an interest rate regressive for large amounts of money held by foreign residents and even those who are residents if necessary.

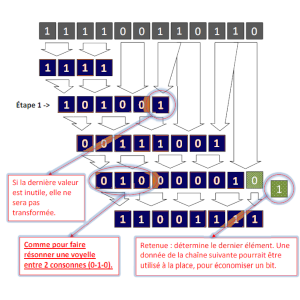

The method by levels can be used for progressive interest rate … otherwise it will be calculated using a progressive curve.

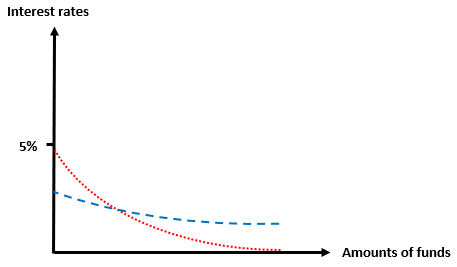

In the event that it would apply a regressive interest rates for bank deposits of citizens … the curve can be calibrated as follows:

funds for citizens

In Figure 1, the red line is the guide to calculate the shape of the curve which calculates the interest rate for the clients of the bank… The header of the graph suggests that it is applied only to citizens, but it can be applied to all bank customers. The blue line is the fitted curve for the riches also receive interest on their bank funds.

|

Back to the top of the page |

The invention of “symmetric debt” will help the US government and other governments to establish a revenue ratio/debt that is balanced in terms of what a government can pay such debt. But this is not a solution that should be abused. In the case of the US government, it is advantageous to use this invention.

This invention was inspired by the parable of Jesus (Mathiashew 13:44) … for the “repurchase” … this hidden treasure. This is a parable that inspired me because basically government securities are a treasure that earns interest, and when the government bought its securities with a symmetrical debt, it pays him interest that would have paid to a foreigner if he had not found the treasure.

Finally, the progressive interest rate affiliated with the solution of the symmetrical debt comes lessen see cancel the negative effects of such measures taken by the ignorance of the people on the tolerance of the debt that has been highlighted in the document “The rage of the economy” (Doc # NEW-ECO-0003-v1-EN).

Businesses and citizens can also have symmetrical debt. However, it plunged the savings rate below the rate of inflation. So obviously this invention “The forges of the economy” is a solution until an agreement with me for my 7th invention…

However, it is advisable to use this invention to “remember” the assets of each individual and to ensure that people have a salary and a job by temporarily holding the GDP to avoid the rampage in case of a crisis more than economic as is currently the case, explained in the document “The rage of the economy” (doc# NEW-ECO-0003-v1-EN) … but this is only temporary because it creates a lot of currency that the rich should spend only on low heat (the business profits only), waiting for the seventh invention. Banks, investment companies, and the bond market to the stock market must be frozen, not bankrupt, waiting to negotiate and obtain the complete solution digitized by me.

Is it that God is good not to let you sink completely and quickly? You already know the answer. And scientists and philosophers speculating a “matrix” must understand that no matrix exists except in their head because it’s not that kind of imagination that creates excitement in the ranks of the people … so watch the speculative bubble, not to lead the world to make psychosis and economic predesasters. This kind of imagination is to entertain in storytelling for children or adults, such as “Assassin’s Creed.” Does the economy, science are a game, or serious or both connected? Think about it-well, because of monumental mistakes, it is very expensive to society.

You need me, Lord God, Jesus, Water and Angels for many other things in the future too, as it must target growth in according with Lord God to keep this growth to be real through new inventions, updating ancient inventions…

|

Back to the top of the page |